Intralinks has a world-class dedicated customer support as well. “We understand the importance of providing state-of-the-art solutions as well as ensuring flawless execution and ultimately, overall excellence in customer experience,” says Sara Cheng, Senior Vice President, Asia Pacific, Banks and Corporates, SS&C Intralinks.

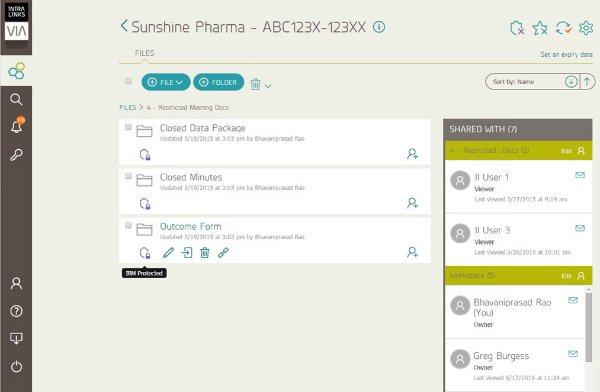

Powered by AI, Intralinks offers redaction and Q&A features that provide real-time intelligence and buyer monitoring on mobile devices, allowing customers to remain adaptable and competitive in the current market. SS&C Intralinks has also developed a feature-rich toolset over the years, supporting productivity for all types of deals throughout the transaction lifecycle, while ensuring security across corporate borders and firewalls. As a result, customers can better manage and execute high-value transactions efficiently and securely, identifying the best potential buyer with the highest bid. Moreover, it significantly shortens the due diligence process, making it invaluable for mergers, acquisitions, initial public offerings (IPOs), capital raises, and debt securities. This solution expedites high-value transactions by streamlining workflows, enabling immediate access to unlimited global buyers with simultaneous access to documents. To alleviate these challenges, SS&C Intralinks offers a seamless and integrated M&A workflow solution that delivers value across the deal – from the early prep phase through due diligence, and ultimately a successful close. Additionally, managing M&A transaction processes using existing inadequate systems can be challenging.

INTRALINKS REDACTION MANUAL

Traditionally, companies resort to manual and time-consuming processes to exchange information and feedback, as well as obtain consent from external parties, which can cause delays in initiating deals. SS&C Intralinks addresses these challenges by providing a centralized and highly secure workspace, effectively resolving various pain points faced by clients. However, it is essential to ensure that the VDR used for M&A transactions is secure and does not compromise data integrity. To mitigate these risks, organizations often rely on Virtual Data Rooms (VDRs) to share sensitive data during M&A transactions. During transmission or storage, unsecured information can be intercepted by malicious outsiders, careless insiders, or accessed by unauthorized parties, posing a significant risk of data breaches. Sara Cheng, Senior Vice President, Asia Pacific, Banks and Corporates Data security is of utmost importance in mergers and acquisitions (M&A) due to the frequent sharing of confidential information among various stakeholders.

0 kommentar(er)

0 kommentar(er)